Request To Waive Penalty : Waw wee: Request To Waive Penalty / Letter Request Waiver ... - Generally, penalty charges will not be waived unless there are exceptional circumstances, such as if your giro payment for levy failed due to the bank's error.

Request To Waive Penalty : Waw wee: Request To Waive Penalty / Letter Request Waiver ... - Generally, penalty charges will not be waived unless there are exceptional circumstances, such as if your giro payment for levy failed due to the bank's error.. Some jurisdictions may waive penalties upon request so you'll have to ask. To know whether you have a kra penalty, just log into your kra itax account; They could waive the death penalty. Taxpayer information ssn or fein: Taxpayer's name (legal name if business) part 2.

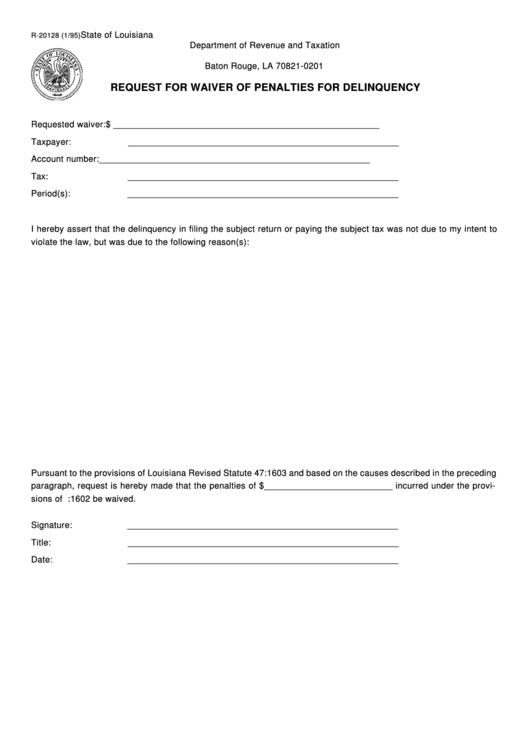

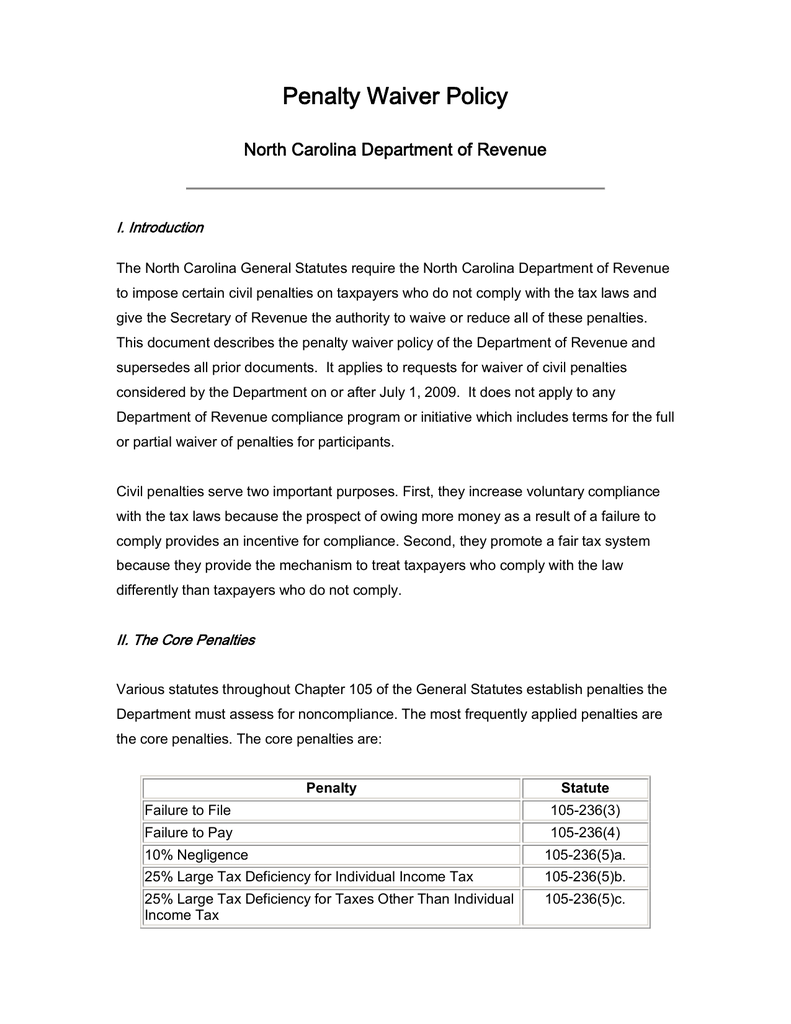

Nc5500 request to waive penalties web 412 north carolina department of revenue part 1. The 10% failure to pay penalty for trust taxes, such as sales tax and withholding tax, is not subject to the good compliance record reasons if the taxpayer. Penalties, there are only two ways to have penalties abated and not all penalties qualify for abatement. Penalty abatement does not remove the penalty only the penalty dollars at the time of request. Waiver of penalty letter example.

It should be addressed to the commissioner of taxation as it requests the commissioner of taxation to allow a waiver of the late tax payment and states reasons for the waive of penalty/late payment of tax.

A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. After six months, you'll also be charged 5% of the tax owed or £300 (whichever is greater), and this happens again after 12 months. The contracting parties are recommended to waive the request for temporary importation papers and. Nc5500 request to waive penalties web 412 north carolina department of revenue part 1. Under 'debt and enforcement', click on 'request for waiver of penalties and interests'. Sdl and/or uif interest can't be waived. In this video, i answer the question about if (and when) the irs will waive penalties and interest and i show you exactly how to request the irs to remove. Interest charged on a penalty will be reduced or removed when that penalty is reduced or removed. Start filling in the fillable pdf in 2 seconds. I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent only one day late because of end of the year mailing issues.the payment was received only request for waiver of late subcharge of tax. When their chances of getting the extra penalties and interest waived is slim, people often wonder what they should do if they cannot pay the total amount in one payment. You may also send a letter to us at the address below explaining the situation and the reason you believe you should not be. List the type(s) of tax for which this request applies along with the amount of penalty and the tax period(s) covered.

Penalty abatement does not remove the penalty only the penalty dollars at the time of request. State the reason you weren't able to pay, and provide copies—never the originals—of the documents you're offering as evidence. Они могут отказаться от смертной казни. Interest charges will still required to be paid even though penalties are waived or reduced. It's true that i paid {number} days late, but there were extenuating circumstances.

Use tax write off sample letter to request unassessed accuracy related.

To avoid penalties in the future, file or pay by the due date. How to request a waiver of interest and penalties on insurance premium taxes, circumstances beyond control, disasters, civil disturbances, service disruptions, serious illness or accident, delay in process, interest, penalties. Simple applications to request the waiving penalties imposed on you or you company. Request to waive the penalty letter. I recognize that a mistake was made by me and would rectify the problem. If an air force installation uses the sample letter as a guide for. State the reason you weren't able to pay, and provide copies—never the originals—of the documents you're offering as evidence. Then provide all of the requested information. In most cases any interest must be charged and cannot be waived since you had use of the money all along. The 10% failure to pay penalty for trust taxes, such as sales tax and withholding tax, is not subject to the good compliance record reasons if the taxpayer. Fill penalty waiver request letter sample, download blank or editable online. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Они могут отказаться от смертной казни.

Taxpayer information ssn or fein: Income tax including corporate income tax (cit). Ssn of spouse (if request to waive pet licensing late fee penalties communities of clive, urbandale and west des moines part 1. To request a waiver, please select request a tax penalty waiver from the dropdown list in the message box on our online form. If an unpaid balance remains on your account, interest will continue to.

To request a waiver, please select request a tax penalty waiver from the dropdown list in the message box on our online form.

Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty. The waiver review process may take up to six weeks. I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent only one day late because of end of the year mailing issues.the payment was received only request for waiver of late subcharge of tax. Unpaid balances will continue to accrue additional penalties and interest which are the responsibility of the tax payers should the waiver request be denied. It's true that i paid {number} days late, but there were extenuating circumstances. Sdl and/or uif interest can't be waived. You may also send a letter to us at the address below explaining the situation and the reason you believe you should not be. To avoid penalties in the future, file or pay by the due date. For {number} years i have made monthly payments on this debt, without exception. Then provide all of the requested information. Start filling in the fillable pdf in 2 seconds. To know whether you have a kra penalty, just log into your kra itax account; Some jurisdictions may waive penalties upon request so you'll have to ask.

Komentar

Posting Komentar